StrikeX: Tokenisation, The Next Billion Users

The transformative potential of blockchain technology is no longer just a concept; it’s a global movement that promises to reshape the foundations of our legacy systems. As we navigate this path forward, the question of widespread adoption looms large. While it took 27 years for the Internet to reach its first billion users, projections suggest that cryptocurrency might achieve the same feat by 2027. The question remains: how will this remarkable expansion unfold?

At StrikeX, we hold the belief that the next billion cryptocurrency users won’t be aware they’re even using blockchain technology. Instead, unbeknownst to them, they will simply be engaging with better products, better technology, and better services, all seamlessly powered by blockchain in the background.

Central to StrikeX’s vision is tokenisation, a paradigm shift in finance that holds immense potential to revamp markets and accelerate blockchain’s mass adoption. Consider the staggering size of the tokenised public stock market: with the global stock market valued at $122 trillion in April 2023, this figure represents the potential scope of tokenised public stocks. While the journey towards a fully tokenised global market remains daunting, key institutions like Citi Group and BlackRock predict an imminent 80-fold surge in tokenisation within seven years, potentially tokenising up to 10% of the global GDP.

Inclusivity and Efficiency

Tokenisation’s profound impact is multifaceted:

1. Access for All

Tokenisation shatters barriers to entry by enabling fractional ownership, allowing more people to invest in traditionally illiquid assets such as fine art and real estate.

2. Efficient Transactions

Through blockchain’s automated smart contracts, transactions are streamlined, costs are minimised, and intermediaries become redundant, leading to an efficient and cost-effective financial ecosystem.

3. Transparency and Security

Tokenisation’s use of blockchain networks guarantees transparency and immutability, fostering trust and confidence among market participants.

4. Global Participation

Tokenisation transcends geographical confines, granting global access to tokenised ecosystems and democratising participation in global markets.

. . .

The potential of tokenisation stretches far beyond these facets, influencing cross-border payments, trade, finance, insurance, and capital markets. This innovation lays the groundwork for a more interconnected and inclusive financial world. Yet, obstacles must be overcome to fully harness its potential.

Recognising the significance of regulated blockchain solutions, StrikeX has forged a pivotal partnership with CMC Markets, a key player in the FTSE250. This collaboration tackles the regulatory void that has side-lined traditional finance’s involvement in blockchain. By leveraging CMC Markets’ industry expertise alongside StrikeX’s web3 technologies, we are building blockchain infrastructure that not only ensures compliance but also fortifies security measures and transparency.

In a recent interview, John Lambert, Chief Digital Officer of MasterCard, noted the importance of this fusion:

“They (Traditional Finance) are unable to come to the table today because there isn’t the framework for them to operate in a safe environment.”

StrikeX is integrating traditional finance with cutting-edge blockchain innovation. By creating an ecosystem that seamlessly blends established financial principles with disruptive technology, we will not only propel web3 toward the next billion users but also build a foundation of trust, security, and inclusivity for the global financial landscape. As the horizon of possibility broadens, the journey toward a blockchain-powered future becomes more promising than ever before.

. . .

The StrikeX Ecosystem

TradeStrike

A 24/7 trading platform for tokenised assets: cryptocurrencies, public securities and other Real-World Assets (RWAs).

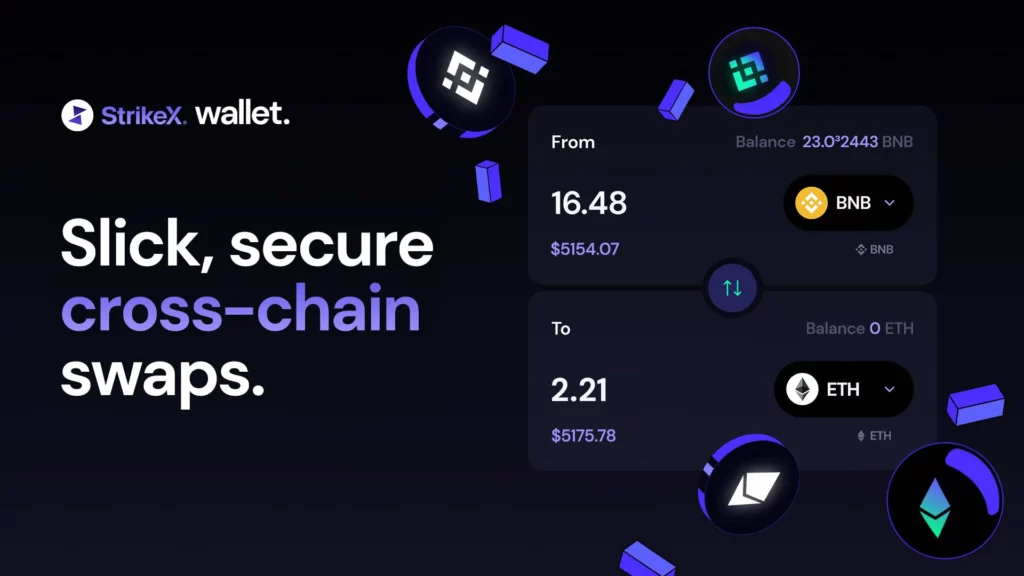

StrikeX | DeFi Crypto Wallet

A non-custodial digital wallet designed to store your digital assets, from cryptocurrencies, Non-Fungible Tokens (NFTs), and tokenised Real-World Assets (RWAs).

TradeX | Decentralised Asset Exchange

A decentralised platform that facilitates seamless trading of your digital assets.

POA Layer1 Network

Our very own POA Layer1 Network, robust blockchain infrastructure custom-made to serve our growing suite of ground-breaking products.

Stock Token Bridge

A blockchain-based bridging mechanism to tokenise public stocks.

. . .

— Joe Jowett, CEO of StrikeX

Learn more about our company on strikex.com

About StrikeX

StrikeX Technologies Ltd is a leading provider of blockchain solutions, specialising in blockchain technology, DeFi, and tokenised assets. The company is dedicated to bridging the gap between traditional finance and Web3, empowering organisations to embrace the transformative power of blockchain.

About CMC Markets

CMC Markets Plc, whose shares are listed on the London Stock Exchange under the ticker CMCX , was established in 1989 and is now one of the world’s leading online financial trading businesses. The Group serves retail and institutional clients through regulated offices and branches in 12 countries and offers an award-winning, online, and mobile trading platform, enabling clients to trade up to 10,000 financial instruments across shares, indices, foreign currencies, commodities, and treasuries.