The Ultimate Guide to the Tokenization of RWAs

Defining Tokenization

Asset tokenization is the process by which an issuer creates digital tokens on a distributed ledger or blockchain. These tokens represent ownership (or fractional ownership) of either physical or digital assets.

The Scope and Potential of Tokenization

Tokenization has vast potential across various industries, transcending traditional boundaries. In addition to real estate and fine art, tokenization can be applied to securities, commodities, intellectual property, and even identity verification. By democratising access to investment opportunities and unlocking liquidity in traditionally illiquid markets, tokenization enables individuals and institutions to participate in asset ownership and value creation like never before.

Benefits of Tokenization

The benefits of tokenization are multifaceted and far-reaching. Increased liquidity allows assets to be traded more efficiently, reducing transaction costs and unlocking value for investors. Fractional ownership enables broader market access, allowing individuals to invest in high-value assets with smaller capital outlays. Blockchain technology ensures transparency and security, as all transactions are recorded immutably on the blockchain, eliminating the risk of fraud or manipulation. Furthermore, tokenization fosters inclusivity by transcending geographical boundaries, granting global access to asset markets and democratising investment opportunities.

Tokenization in the Stock Market

Touted as ‘Crypto’s killer use-case,’ tokenization has the potential to revolutionise the traditional securities market by offering fractional ownership, programmable features, enhanced liquidity and 24/7 market access. Leading institutions like BlackRock are exploring tokenization to create innovative investment opportunities and reshape the securities market landscape. Programmable dividends, voting rights, and governance mechanisms are just some of the features that tokenized securities can offer, providing investors with greater flexibility and customisation in their investment portfolios.

Leading Institutions Embracing Tokenization

Prominent financial institutions, including HSBC, JP Morgan, CMC Markets, Citigroup, and Deutsche Bank, are actively embracing tokenization across various sectors. From trade finance and payments to digital asset custody, these institutions are leveraging blockchain technology to drive innovation and efficiency in financial services. By collaborating with blockchain start-ups and investing in tokenization initiatives, these institutions are positioning themselves at the forefront of the digital asset revolution.

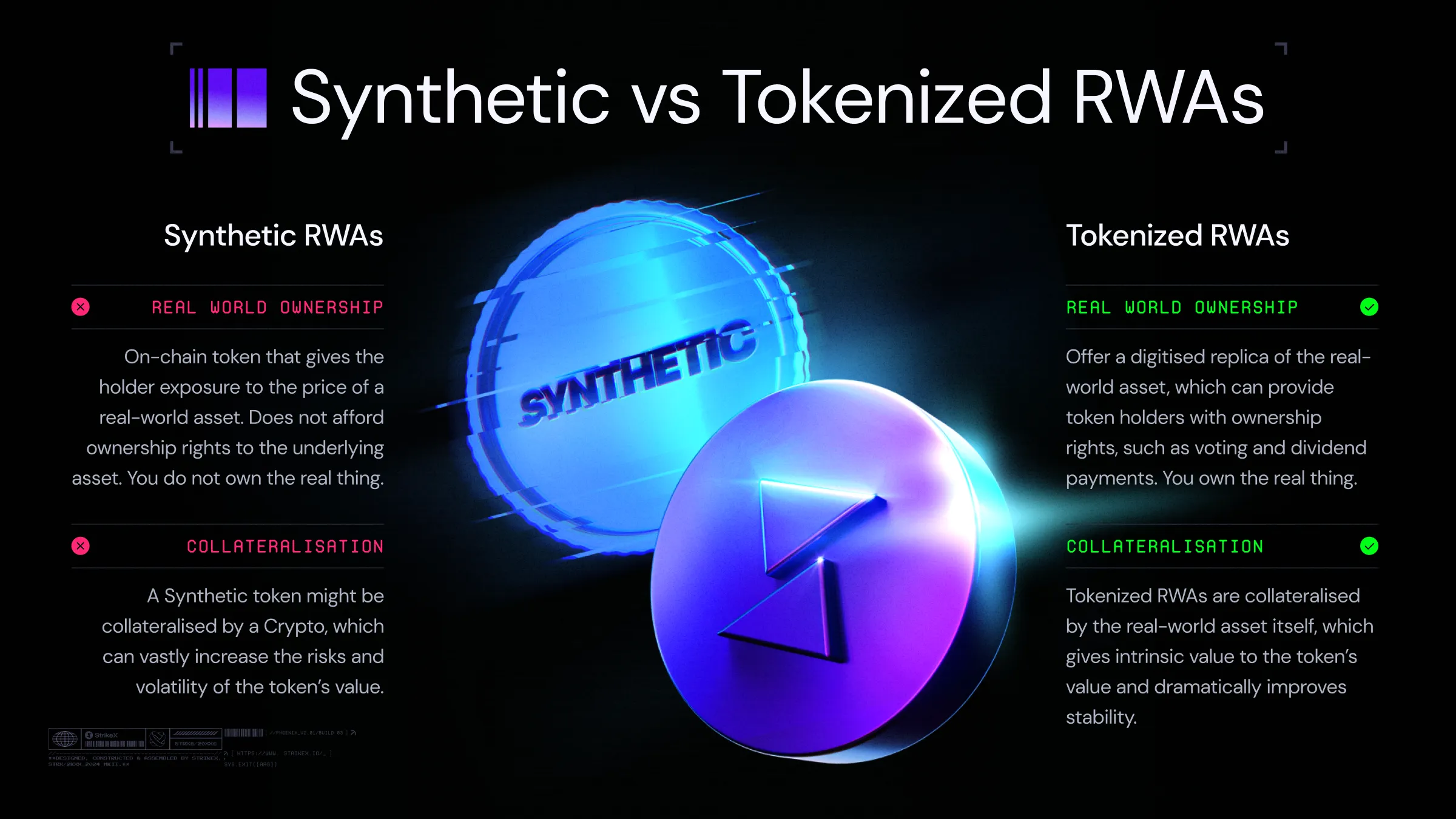

Differentiating Synthetic vs Tokenized RWAs

Understanding the distinction between synthetic and tokenized real-world assets (RWAs) is crucial for navigating the evolving landscape of tokenization. Synthetic RWAs provide price exposure to real-world assets through derivatives, such as futures contracts or options, without direct ownership of the underlying asset. On the other hand, tokenized RWAs represent direct ownership or fractional ownership of the underlying asset, allowing investors to hold digital tokens that correspond to tangible assets. By understanding the differences between synthetic and tokenized RWAs, you can make informed decisions about your investment strategies and risk exposure in the tokenization market.

The BlackRock BUIDL Token and 24/7 Trading

BlackRock’s new BUIDL token exemplifies the innovative potential of tokenization in the financial market and has ignited widespread interest in the space. The BUIDL token allows investors to earn yield while holding a stablecoin backed by real-world assets. With collateralisation mechanisms ensuring the stability and security of the BUIDL token, investors can participate in 24/7 trading environments and passively earn yield on their investments. The introduction of such of BlackRock’s BUIDL token demonstrates the transformative power of tokenization in creating new investment opportunities and driving liquidity in financial markets.

Self-Custody of RWAs

Self-custody solutions empower investors to securely manage their digital assets without relying on third-party intermediaries. By utilising self-custody wallets, decentralized finance (DeFi) platforms, or other self-custody solutions, investors can maintain control over their digital assets while minimising counterparty risk. These solutions offer enhanced security, privacy, and control over digital assets, empowering investors to participate in the tokenization market with confidence in autonomy.

The Tokenization Landscape Across industries

Tokenization extends beyond the financial sector, with applications spanning various industries. From real estate and art to supply chain management and intellectual property, tokenization offers transformative opportunities for digitising and monetising assets. For instance, in real estate, tokenization allows investors to access fractional ownership of properties, enabling diversification and liquidity in the market. Similarly, in supply chain management, tokenization enhances transparency and traceability, reducing fraud and inefficiencies. By exploring the diverse applications of tokenization across industries, stakeholders can identify new avenues for value creation and innovation.

Regulations and Compliance in Tokenization

As the tokenization market matures, regulatory frameworks play a crucial role in shaping its growth and adoption. Regulatory compliance ensures investor protection, market integrity, and financial stability in tokenized asset markets. Key considerations include securities laws, anti-money laundering (AML) regulations, and investor protection measures. Tokenization platforms must adhere to regulatory standards and implement robust compliance measures, in doing so they can foster trust and confidence among investors and regulatory authorities, facilitating the responsible growth of the tokenization market.

Future Trends and Outlook

The future of tokenization holds immense promise and potential. Continued innovation in blockchain technology, interoperability, and scalability will drive further adoption of tokenized assets across global markets. Other emerging technologies such as Artificial intelligence (AI), non-fungible tokens (NFTs), and central bank digital currencies (CBDCs) are expected to intersect with tokenization, creating new opportunities and challenges for market participants. By staying abreast of these trends and leveraging technological advancements, stakeholders can position themselves to capitalise on the evolving landscape of tokenization and drive forward the future of finance.

Conclusion

The tokenization of real-world assets represents a transformative shift in the financial landscape, unlocking liquidity, accessibility, and transparency in asset markets. From fractional ownership and programmable features to 24/7 market access and beyond, tokenization offers a myriad of benefits and opportunities for investors and stakeholders alike. By understanding the fundamentals of tokenization, navigating regulatory landscapes, and embracing future trends, stakeholders can harness the full potential of tokenized assets and contribute to the ongoing evolution of the tokenized economy.

. . .

— Joe Jowett, CEO of StrikeX

Learn more about our company on strikex.com

About StrikeX

StrikeX Technologies Ltd is a leading provider of blockchain solutions, specialising in blockchain technology, DeFi, and tokenised assets. The company is dedicated to bridging the gap between traditional finance and Web3, empowering organisations to embrace the transformative power of blockchain.

About CMC Markets

CMC Markets Plc, whose shares are listed on the London Stock Exchange under the ticker CMCX , was established in 1989 and is now one of the world’s leading online financial trading businesses. The Group serves retail and institutional clients through regulated offices and branches in 12 countries and offers an award-winning, online, and mobile trading platform, enabling clients to trade up to 10,000 financial instruments across shares, indices, foreign currencies, commodities, and treasuries.